U.S. Inflation Rises as Corporate Earnings Fuel Market Highs

United States

Strong Earnings Lift Markets to New Highs

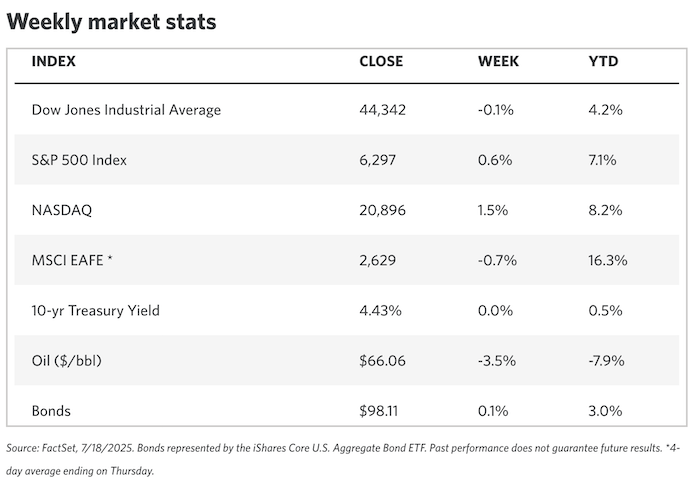

The S&P 500 and Nasdaq Composite both hit new all-time highs last week, driven by strong Q2 earnings and generally positive economic data. The Russell 2000 also rose, while the Dow Jones Industrial Average and S&P Midcap 400 ended slightly lower.

The earnings season kicked off with major banks like JPMorgan Chase and Citigroup reporting better-than-expected results. Later in the week, consumer-facing companies such as PepsiCo, United Airlines, and Netflix also topped forecasts.

NVIDIA rallied after receiving approval from the Trump administration to sell its H2O AI chips to China. The company, which recently hit a $4 trillion market cap, surged on the news.

Inflation Picks Up; Retail Sales Rebound

June CPI rose 0.3% month over month—its biggest jump in five months—matching expectations. On a year-over-year basis, inflation accelerated to 2.7%, while core CPI rose to 2.9%, up from 2.8% in May. Prices for household goods, recreation, and footwear saw notable increases, partly offset by declining vehicle prices.

Retail sales rose 0.6% in June, rebounding from May’s 0.9% drop. Midweek market jitters over reports that President Trump might remove Fed Chair Jerome Powell were quickly reversed after Trump denied the rumor.

Corporate Bonds Outperform Treasuries

Intermediate- and long-term Treasury yields held steady, while short-term yields edged lower amid speculation around the Fed. Investment-grade corporate bonds outperformed Treasuries, with new issues largely oversubscribed.

Europe

Markets Mixed as Investors Eye Trade Talks

The STOXX Europe 600 finished flat, as investors monitored progress in U.S.-EU trade discussions. Italy’s FTSE MIB rose 0.58%, France’s CAC 40 and Germany’s DAX were little changed, and the UK’s FTSE 100 gained 0.57%, helped by a weaker pound.

UK Inflation Surges; Labor Market Softens

UK inflation surprised to the upside, rising to 3.6% in June—the highest since January 2024—driven by higher fuel prices. Core services inflation held at 4.7%, showing persistent cost pressures.

The job market weakened. The unemployment rate ticked up to 4.7%, and payrolls fell by 41,000 in June. Wage growth (excluding bonuses) came in at 5.0%, slightly above forecasts but down from 5.3% in May.

Eurozone Industrial Output Rebounds

Industrial production in the euro area rose 1.7% in May, beating expectations and reversing April’s 2.2% drop. Strong output in energy, capital goods, and non-durable consumer goods contributed to the gain. Year over year, output rose 3.7%.

The region’s trade surplus widened to €16.2 billion, up from €12.7 billion a year ago, as exports grew and imports fell.

German Sentiment at 3-Year High

Germany’s ZEW economic sentiment index rose for the third month in a row, reaching 52.7—the highest since February 2022. Optimism was driven by hopes for EU stimulus and resolution of U.S.-EU trade tensions.

Asia-Pacific

Japan: Modest Gains Ahead of Elections

Japanese equities posted moderate gains, with the Nikkei 225 up 0.63% and the TOPIX rising 0.40%. Investors await results from the July 20 Upper House election, which could impact Prime Minister Shigeru Ishiba’s coalition majority.

The 10-year JGB yield rose to 1.53%, while the yen weakened toward 148 per U.S. dollar.

Cooling Inflation, Weak Exports

Core CPI rose 3.3% in June, below expectations and down from 3.7% in May, due mainly to lower energy costs. Exports fell 0.5% year over year, missing forecasts, with declines in autos, parts, and pharmaceuticals. A new 25% U.S. tariff on Japanese goods is set to take effect August 1, though bilateral talks are ongoing.

China: Solid GDP, But Risks Loom

Mainland Chinese markets advanced, with the CSI 300 up 1.09% and the Shanghai Composite up 0.69%. Hong Kong’s Hang Seng jumped 2.84%.

China’s Q2 GDP grew 5.2% year over year, slightly above expectations, easing near-term pressure for stimulus. However, deflation concerns, soft retail sales, and upcoming U.S. trade deadlines pose headwinds.

The real estate downturn persists: new home prices fell 0.27% in June, while existing home prices dropped 0.61%. Residential sales fell 12.6% year over year—the largest decline in 2025 so far.

Other Key Markets

Indonesia: Rate Cut and U.S. Trade Deal

Indonesia’s central bank cut its benchmark rate from 5.50% to 5.25%, citing lower inflation forecasts and the need to support growth. Separately, the U.S. and Indonesia finalized a trade deal that set tariffs at 19%—down from an initially proposed 32%. Indonesia also agreed to purchase Boeing aircraft and import over $20 billion in U.S. energy and agricultural goods.

Peru: Central Bank Holds Steady

Peru’s central bank kept its policy rate at 4.50%, as expected. Annual inflation remained at 1.7% in June, with stable 12-month inflation expectations at 2.3%. Policymakers noted that global inflation expectations—particularly in the U.S.—may slow the path back to target inflation locally.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Leave a Reply