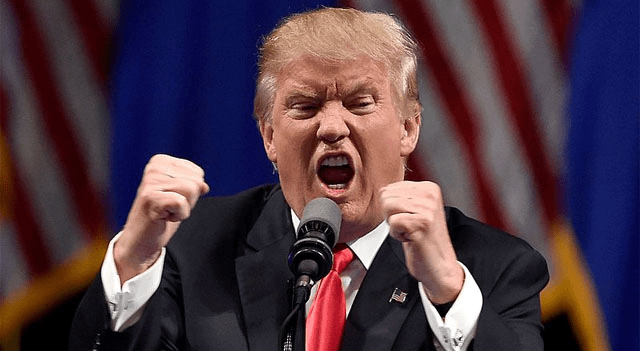

Futures tied to major U.S. equity indices edged higher on Wednesday as investors cautiously looked ahead to President Donald Trump’s speech at the World Economic Forum in Davos. Markets remain on edge over Trump’s renewed push for U.S. control of Greenland and his threats to impose additional tariffs on several European countries — issues expected to feature prominently in his meetings with world leaders on the sidelines of the event. Elsewhere, Netflix (NASDAQ:NFLX) issued restrained financial guidance after enhancing its bid for Warner Bros. Discovery (NASDAQ:WBD), while a regulatory filing suggested Berkshire Hathaway (NYSE:BRK.B) could reduce or exit its stake in Kraft Heinz (NASDAQ:KHC).

Futures edge up

U.S. stock futures pointed modestly higher, indicating a tentative rebound after Wall Street suffered its sharpest one-day decline since October in the previous session.

By 02:21 ET, Dow futures were up 103 points, or 0.2%, S&P 500 futures had risen 27 points, or 0.4%, and Nasdaq 100 futures were higher by 114 points, or 0.5%.

Markets were rattled on Tuesday as geopolitical and trade concerns resurfaced following President Trump’s warning that he could impose fresh tariffs on several European countries if his demands regarding Greenland were not met. U.S. Treasury yields climbed sharply, pushing the benchmark 10-year yield to its highest level since August, while the dollar weakened against a basket of major currencies.

Investors are now weighing how likely Trump is to follow through on his threats and how aggressively European governments might respond. Adding to the cautious mood, Japanese government bond yields have also been rising ahead of a snap election scheduled for early next month.

Trump in the spotlight at Davos

Trump is set to take center stage later on Wednesday as he attends the World Economic Forum in Switzerland.

He is expected to meet with a number of global leaders and continue pressing his case for Greenland, the semi-autonomous Danish territory he argues the U.S. needs for national security reasons.

On Tuesday, Trump struck a slightly softer tone, saying he wanted to reach an agreement that would make America’s NATO allies “very happy.” However, when asked how far he would be willing to go to secure Greenland, he replied simply, “You’ll find out.”

Despite the more conciliatory language, markets remain nervous. Trump has warned he could impose additional 10% tariffs on eight European countries over the issue, potentially lifting them to 25% in June if his demands are not met. European leaders have described the threat as blackmail, a message echoed at Davos by French President Emmanuel Macron.

According to the Wall Street Journal, Trump’s speech is also expected to outline elements of his second-term economic agenda, where tariffs continue to play a central role.

Netflix posts “mixed” outlook

Netflix shares fell in after-hours trading after the streaming giant released guidance that investors viewed as cautious, as it pursues a major acquisition of Warner Bros. Discovery.

The company forecast first-quarter operating margins of 32.1% and revenue of $12.16 billion, both below Wall Street expectations. For 2026, Netflix projected revenue with a midpoint of $51.2 billion, ahead of forecasts, but an operating margin of 31.5%, nearly 100 basis points below analyst estimates due in part to roughly $275 million in acquisition-related costs.

That said, Netflix reported strong fourth-quarter results, with revenue rising to $12.05 billion and net income to $2.42 billion, supported by popular releases including the final season of “Stranger Things” and the launch of “Frankenstein.” Paid memberships also surpassed 325 million.

The results followed Netflix’s move to improve its roughly $72 billion offer for Warner Bros.’ studios and streaming assets, as it competes in a bidding battle with Paramount Skydance.

Jefferies analysts described the earnings as “mixed,” adding that “[i]ncreased deal certainty” would be a “positive catalyst” for the stock.

Later on Wednesday, attention will also turn to earnings reports from Johnson & Johnson and Charles Schwab.

Berkshire signals possible Kraft Heinz exit

After U.S. markets closed, Berkshire Hathaway disclosed that it could sell up to 325 million shares of Kraft Heinz — effectively its entire holding in the food group and about 27.5% of the company’s outstanding shares.

Berkshire has previously written down the value of its Kraft Heinz stake and has been critical of the company’s strategy, including plans to break up its operations. Kraft Heinz shares fell more than 3% in after-hours trading following the filing.

Analysts at Vital Knowledge said the potential divestment would mark the “first major corporate action” under Berkshire’s new chief executive, Greg Abel, successor to Warren Buffett. They added that the move suggests Abel is “already working to put his imprint on the firm’s sprawling portfolio” and reflects “purely” a pessimistic outlook for the packaged food sector, rather than any need for liquidity.

Gold hits fresh records

Gold prices surged to new all-time highs on Wednesday, breaking above $4,800 an ounce and nearing $4,900, as escalating tensions linked to Greenland and renewed trade frictions unsettled markets and boosted demand for safe-haven assets.

Spot gold rose 2.3% to $4,862.75 an ounce by 03:35 ET, after earlier touching a record $4,887.82. U.S. gold futures also climbed 2.1% to a new high of $4,865.91.

Oil prices, meanwhile, fell sharply on concerns that U.S. tariff threats could weigh on global growth. The declines followed gains of nearly 1.5% in the previous session, after OPEC+ producer Kazakhstan temporarily halted output at two oilfields, raising supply worries.

Beyond geopolitics, markets are awaiting the International Energy Agency’s monthly report later in the day, as well as upcoming data on U.S. crude oil and gasoline inventories.