Concurrent Technologies (LSE:CNC) said unaudited revenue and profit before tax for 2025 are expected to be in line with market expectations, while also delivering strong double-digit growth year on year. Performance was underpinned by record order intake of around £47 million and a solid net cash position of £14.4 million, achieved despite delays to parts of the US defence budget and disruption from a government shutdown.

Momentum during the year was driven by continued strength in the group’s Products and Systems divisions, alongside increasing contribution from its design services activity. This included the award of a $6.2 million defence contract, the largest single order in the company’s history, highlighting growing customer demand for its specialist capabilities. Operational capacity has also been expanded, with new facilities in Los Angeles now fully operational and a planned relocation in Colchester on track for completion in the first half of 2026.

Looking ahead, management pointed to a robust pipeline of design wins and improving operational scale as foundations for sustaining growth, while continuing to actively manage component costs and supply-chain pressures. Although valuation and short-term technical indicators remain areas of focus for investors, the company said its strong order book and balance sheet position provide confidence in its medium-term outlook.

More about Concurrent Technologies

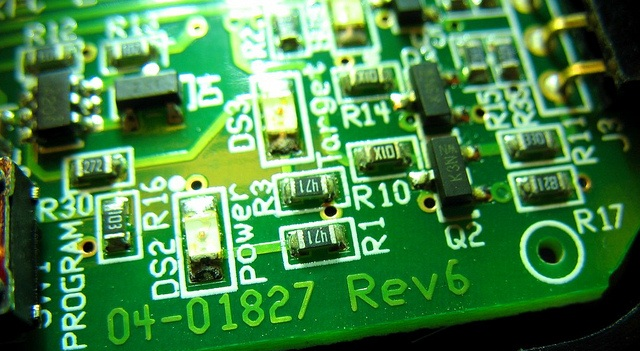

Concurrent Technologies Plc is a UK-based designer and manufacturer of high-performance embedded computer products, systems and mission-critical solutions. Its Intel-based processor cards and systems are used in long life-cycle and high-reliability applications across defence, telecommunications, security, aerospace, scientific and industrial markets worldwide, including harsh and safety-critical environments.