European stocks rose on Friday, bouncing back after three consecutive sessions of losses amid investor jitters over the conflict in the Middle East and the potential for U.S. involvement.

At 07:15 GMT, Germany’s DAX index gained 0.8%, France’s CAC 40 climbed 0.6%, and the U.K.’s FTSE 100 rose 0.4%. Despite the intraday gains, all three benchmark indices were set for weekly losses, with the DAX down nearly 2%, the CAC 40 off 1.7%, and the FTSE 100 0.7% lower as of Thursday’s close.

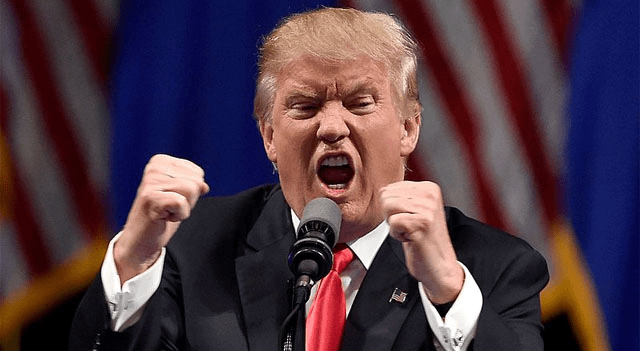

Trump Postpones Iran Decision by “Two Weeks”

Investor anxiety about the U.S. becoming involved in the Israel-Iran conflict dominated much of the week, especially after President Donald Trump hinted at the possibility of joining Israel’s air campaign.

Sentiment improved after Trump announced late Thursday that a decision on whether to launch a U.S. attack on Iran would be delayed by “two more weeks.” This announcement eased concerns that a strike was imminent, following numerous earlier reports suggesting such action could happen imminently.

Trump has previously used two-week deadlines for key decisions such as tariff negotiations, raising hopes that Tehran might be pressured into negotiations during the interim.

Dovish Central Banks

Earlier on Friday, China kept its benchmark lending rates steady, as widely expected. This followed a series of policy meetings by European central banks on Thursday, which all sent dovish signals.

Norway’s central bank cut rates for the first time since 2020, the Swiss National Bank lowered rates to zero without ruling out negative rates, and the Bank of England held its policy steady but acknowledged the need for further easing.

The potential for additional easing was underscored by U.K. retail sales, which recorded their sharpest decline since December 2023 in May, as consumer demand fell back after strong spending on food, summer apparel, and home improvements the prior month.

Retail sales volumes dropped 2.7% in May, according to the Office for National Statistics — a much steeper fall than the 0.5% decline economists had forecast.

Additionally, German producer prices declined by 1.2% year-on-year in May, in line with expectations.

Berkeley Changes Management

In corporate news, Berkeley Group (LSE:BKG) reported an increase in pretax profit for the year ending April 30 despite regulatory pressures and lower forward sales.

The homebuilder also announced that Chairman Michael Dobson will step down after the company’s AGM in September. CEO Rob Perrins is set to become executive chair, and CFO Richard Stearn will be appointed CEO.

Crude Slips on Trump Pause

Crude oil prices fell on Friday following President Trump’s decision to delay action on U.S. involvement in the Iran-Israel conflict, but prices remained on track for a third consecutive week of gains.

At 03:15 ET, Brent futures dropped 2.6% to $76.79 a barrel, while U.S. West Texas Intermediate crude fell 0.4% to $73.61 a barrel, with the U.S. market closed on Thursday for a holiday.

Both contracts were positioned for weekly gains exceeding 3%, as the ongoing conflict between Israel and Iran showed no signs of resolution, continuing to threaten crude supply from this key oil-producing region.

Leave a Reply