European equities faced a lack of clear direction on Monday as investors closely monitor ongoing international trade discussions ahead of the looming July 9 deadline for U.S. reciprocal tariffs.

Tensions eased somewhat after Canada decided to withdraw its previously planned Digital Service Tax (DST) targeting U.S. tech companies.

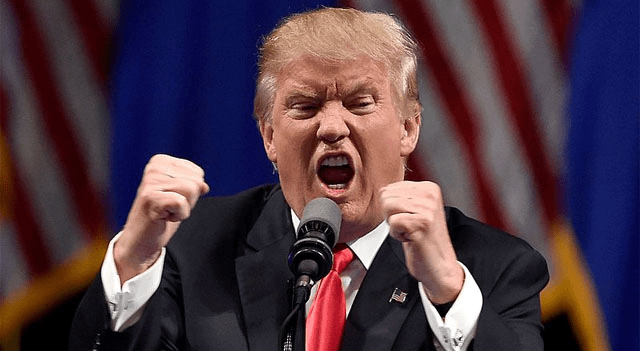

Meanwhile, U.S. President Donald Trump criticized trade conditions involving automobiles between the U.S. and Japan, labeling them as imbalanced, and suggested that the 25% tariffs on imported Japanese cars might remain in place.

In a related development, a new trade pact between the United States and the United Kingdom officially took effect today, lowering U.S. tariffs on British-manufactured cars and aircraft components.

At midday, the French CAC 40 Index edged up slightly by 0.1%, whereas the U.K.’s FTSE 100 Index and Germany’s DAX Index each retreated by 0.2%.

On the corporate front, Skanska AB (USOTC:SKSBF) saw its shares dip following the announcement of a significant investment, approximately SEK 700 million (about CZK 1.6 billion), in a residential development named D.O.K. Radlice situated in Prague’s Radlice neighborhood.

Defense technology company Chemring (LSE:CHG) gained ground after revealing its plan to acquire Landguard Nexus Limited in a deal valued at up to £20 million.

Shares of STMicroelectronics (NYSE:STM) and Infineon Technologies (TG:IFX) also rose, buoyed by J.P. Morgan placing both on a positive catalyst watchlist.

Leave a Reply