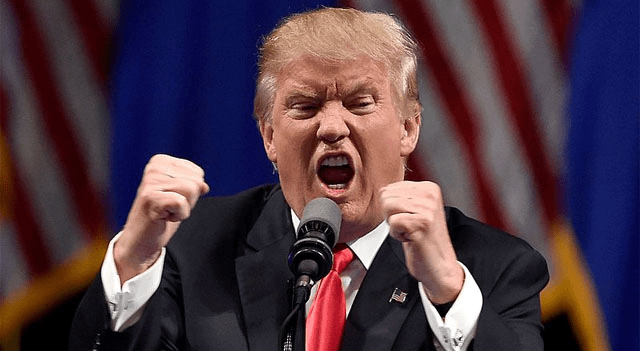

European equities edged lower on Monday following U.S. President Donald Trump’s warning of a 30% tariff on imports from the European Union, sparking fears of a prolonged and deeper economic slowdown.

Reports indicate that the EU has prepared a retaliatory tariff package worth €21 billion ($24.52 billion) aimed at U.S. products should trade negotiations fail.

The STOXX 600, a broad index covering European stocks, declined by 0.3%, following a 1% drop on Friday.

Germany’s DAX Index lost 0.8%, while France’s CAC 40 fell 0.4%. In contrast, the U.K.’s FTSE 100 defied the downward trend, climbing 0.4%.

Automobile manufacturers took a hit, with Volkswagen (TG:VOW3), BMW (TG:BMW), Mercedes-Benz (TG:MBG) and Porsche (BIT:1PORS) each dropping close to 2%.

On a brighter note, mining giant BHP (LSE:BHP) rose approximately 1% after signing preliminary agreements with Chinese battery makers CATL and BYD to explore opportunities in battery technology and electrification.

AstraZeneca (LSE:AZN) shares jumped 2% in London after positive late-stage trial results showed that its experimental drug baxdrostat effectively lowered high blood pressure.

French defense stocks were on the rise after President Emmanuel Macron called on Sunday for a substantial increase in France’s defense budget, citing escalating risks from Russia.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Leave a Reply