Concurrent Technologies Plc (LSE:CNC) delivered record-breaking results in the first half of 2025, with significant revenue and order intake growth year-over-year. The company continues to secure key strategic design wins, reinforcing confidence in its medium- and long-term growth trajectory. The recent launch of the unique Kratos product has attracted strong market interest. Despite potential headwinds from US contract challenges and global supply chain disruptions, Concurrent remains on course to achieve its full-year targets.

The company’s robust financial performance and strategic developments are key drivers behind its positive score. Technical indicators suggest moderate bullish momentum, although valuation concerns persist due to a high price-to-earnings ratio and a low dividend yield.

About Concurrent Technologies

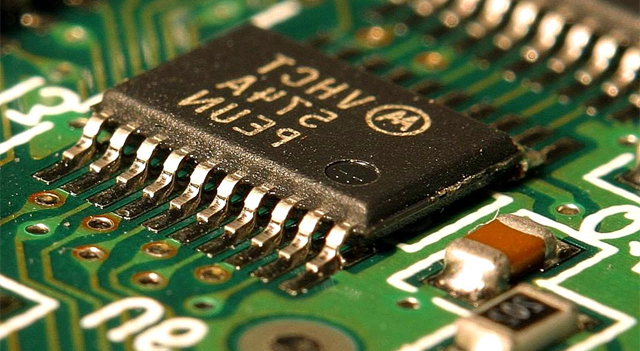

Concurrent Technologies Plc specializes in the design and manufacture of advanced embedded plug-in cards and systems. Serving telecommunications, defense, security, telemetry, scientific, and aerospace sectors, their products utilize Intel processors and are engineered for high performance and long lifecycle applications, meeting stringent industry standards and supporting numerous embedded operating systems.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Leave a Reply