CML Microsystems (LSE:CML) shared a positive trading update at its Annual General Meeting, confirming that the company is on track to meet internal financial targets for the year, particularly with momentum expected to build in the second half. A key highlight was the signing of a substantial 12-year design and supply agreement valued at over $30 million, marking a significant win for the business.

In addition, CML has finalized the sale of surplus land for £7 million, further bolstering its balance sheet and enhancing its ability to support sustainable growth over the medium term. These developments have reinforced the board’s confidence in delivering long-term shareholder value and advancing the company’s strategic goals.

Despite these positive indicators, the company continues to face some headwinds in profitability and cash flow management. Technical signals hint at possible near-term downside pressure, although the firm’s compelling dividend yield may be attractive to income-focused investors seeking stable returns.

About CML Microsystems

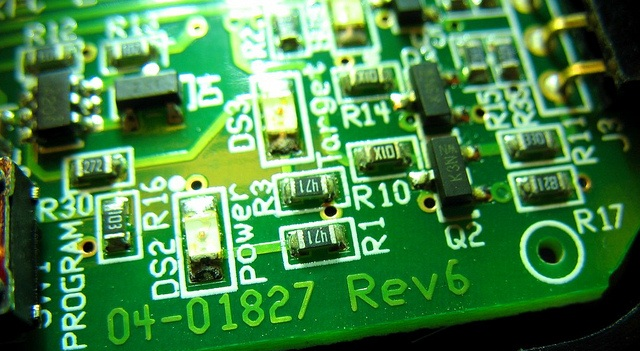

CML Microsystems Plc designs and manufactures advanced mixed-signal, RF, and microwave semiconductor components for the global communications sector. Headquartered in the UK with operations across Asia and the United States, the company targets niche segments within the communications market characterized by high growth potential and significant entry barriers.

Its diverse customer base includes top-tier commercial and industrial product manufacturers. CML is well-positioned to benefit from rising demand for faster, more secure data transmission, continued investment in telecom infrastructure, and the expansion of private wireless networks connected to the industrial Internet of Things (IIoT).

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Leave a Reply