Severfield plc (LSE:SFR) has reported trading in line with expectations, with market conditions remaining steady since its FY25 results. The company continues to maintain a strong financial position, supported by an extended £60 million Revolving Credit Facility and a focus on cash generation. Its order books are solid, with £420 million in the UK and Europe and a record £252 million in India. Progress on the bridge remedial works program is proceeding as planned, and the company has secured a £20 million insurance recovery. Severfield is scheduled to release its half-year financial results on 25 November 2025.

The outlook reflects ongoing financial pressures, particularly from declining revenues and cash flow constraints. Technical indicators show mixed momentum, while valuation is supported by a high dividend yield but tempered by a negative P/E ratio. Limited corporate events and earnings call data constrain additional insights.

About Severfield

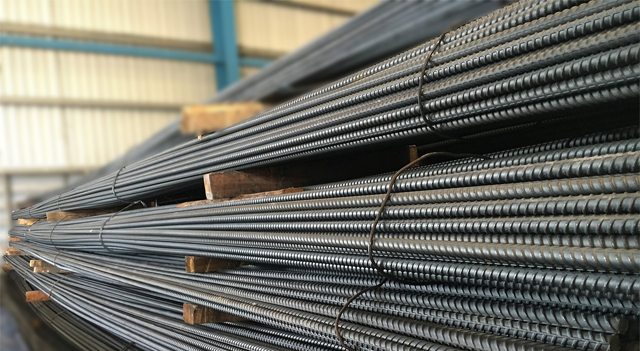

Severfield is the UK’s leading structural steel company, specializing in the design, fabrication, and construction of complex steel projects, with an annual production capacity of approximately 150,000 tonnes. The Group operates seven sites, employs around 1,800 people, and has a strong presence in India through a joint venture with JSW Steel, the country’s largest steel producer.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Leave a Reply