EnSilica (LSE:ENSI) delivered record unaudited results for the six months to 30 November 2025, with revenue rising 37% year on year to £12.7m. Growth was driven by a continued shift away from a predominantly consultancy-led model toward a more scalable, multi-stream business, as chip supply revenue increased 34% to £3.9m and recurring income streams became a larger part of the mix.

The group moved into profitability at the operating level, reporting EBITDA of £1.7m and an operating profit of £0.4m. Operating cash flow reached £4.4m during the period, while cash at the half year end stood at £2.0m. EnSilica continued to invest for growth, committing £3.1m to supply contracts and intellectual property as it builds long-term recurring revenues and royalties in higher-growth markets such as satellite communications and secure semiconductor applications.

Operational progress remained strong. The company advanced multiple ASIC programmes toward production, with five ASICs now in the supply phase and cumulative shipments exceeding 10 million devices on a long-running automotive programme. During the half, EnSilica also secured a $1.4m satellite payload order and won a £5m UK government contract to develop a secure, quantum-resilient processor ASIC for critical infrastructure. In addition, a new mixed-signal design centre was opened in Budapest, further strengthening the group’s European engineering footprint.

With more than 95% of expected FY26 revenue already covered by contracted work and a robust pipeline of design and non-recurring engineering projects feeding future chip supply, the board reiterated confidence in meeting full-year expectations. Management highlighted the growing resilience and scalability of the business model as recurring chip revenues increase, supporting EnSilica’s competitive position in advanced ASIC markets.

From an investment perspective, strong operational delivery and momentum are tempered by concerns around historical losses and free cash flow volatility. Technical indicators remain supportive, with the share price trading well above key moving averages, although momentum is approaching more stretched levels. Valuation remains constrained by negative earnings and the absence of a dividend.

More about EnSilica PLC

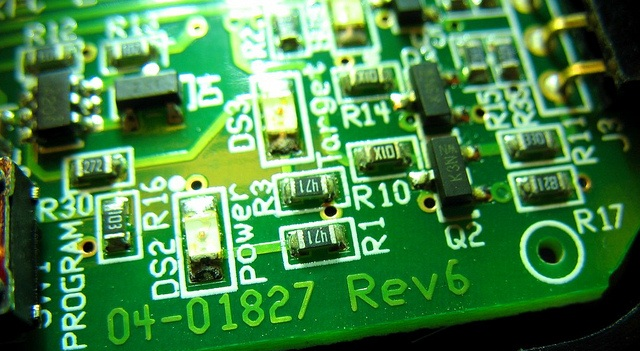

EnSilica plc is a fabless application-specific integrated circuit (ASIC) designer specialising in mixed-signal, RF and mmWave semiconductors. The company serves communications, industrial, automotive and healthcare markets where safety, security and reliability are critical. EnSilica operates from its headquarters in Oxford, with additional design centres in the UK, India, Brazil and Hungary, and leverages a growing portfolio of reusable IP and silicon platforms to shorten customer development cycles and support long-term chip supply revenues.

Leave a Reply