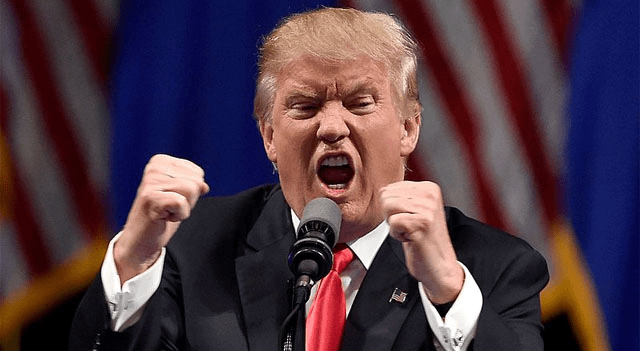

European shares declined on Friday following new tariff announcements by U.S. President Donald Trump targeting Canada, sparking concerns that the European Union could be next in line for increased trade restrictions.

By 08:05 GMT, Germany’s DAX index fell 0.8%, France’s CAC 40 slipped 0.6%, and the U.K.’s FTSE 100 edged down 0.2%.

Trump escalates trade tensions

On Thursday evening, Trump unveiled a 35% tariff on Canadian imports effective August 1, alongside plans to impose broad tariffs ranging from 15% to 20% on various other trading partners.

These moves have raised worries that the EU may soon receive similar tariff notices, putting trade negotiations between Washington and Brussels in jeopardy.

EU Trade Commissioner Maros Sefcovic recently acknowledged progress toward a trade framework but warned no final agreement has been reached, and Trump’s patience may wear thin.

UK economy contracts again in May

On the economic front, French consumer inflation was revised up to 0.9% for June, slightly exceeding forecasts, while German inflation eased to 2.0%. These trends suggest the European Central Bank retains ample scope to ease monetary policy further, likely in September, to support growth.

In June, the ECB cut borrowing costs for the eighth time in a year, lowering its key deposit rate by 25 basis points to 2.0%.

Meanwhile, the Bank of England may also consider rate cuts soon after UK GDP unexpectedly shrank for a second consecutive month in May.

Official data from the Office for National Statistics showed a 0.1% monthly decline in UK GDP for May, following a sharper 0.3% drop in April — the largest fall since October 2023.

BP’s production outlook impresses investors

In corporate news, BP (LSE:BP.) shares rose after the oil giant forecast higher-than-expected upstream production for Q2, despite pressures from lower gas and oil prices.

Other corporate updates

Swedish hotel operator Pandox (USOTC:PNDXF) reported a 2% year-on-year rise in second-quarter revenues, supported by recent acquisitions.

UniCredit (BIT:UCG) reaffirmed its plans to pursue a takeover of Germany’s Commerzbank (TG:CBK), despite opposition from the German government. CEO Andrea Orcel told board members that the bank will continue its bid, highlighting a recent increase in its equity stake to over 9%.

Oil prices edge up amid sanction worries

Oil prices rose slightly Friday, supported by growing expectations of new sanctions on Russia, although gains were limited by tariff concerns and increased OPEC+ output.

By 04:05 ET, Brent crude futures were up 0.2% at $68.80 per barrel, and West Texas Intermediate climbed 0.3% to $66.79 per barrel.

Both contracts had fallen more than 2% the previous day as investors fretted about the economic fallout from Trump’s tariff escalation.

Sentiment improved after Trump voiced frustration with Russian President Vladimir Putin over stalled Ukraine peace talks, signaling a possibility of harsher penalties against the oil-producing nation.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Leave a Reply