Sylvania Platinum Limited (LSE:SLP) reported robust results for the fourth quarter ending June 2025, with a 3% increase in 4E PGM ounces produced and a record annual output of 81,002 4E PGM ounces. Net revenue rose 15% quarter-on-quarter, while EBITDA nearly doubled, driven by higher production volumes and rising platinum group metal (PGM) prices. The Thaba Joint Venture project has begun commissioning and is expected to significantly boost future production and revenue. The company also recorded its best-ever safety performance, achieving important milestones in injury-free operations, underscoring its commitment to operational excellence.

Sylvania Platinum’s strong operational metrics and positive corporate developments contribute to a favorable overall outlook. Despite a stable financial position, some challenges remain, including declining revenue trends and negative free cash flow. However, the company’s attractive valuation and high dividend yield add to its investment appeal.

About Sylvania Platinum

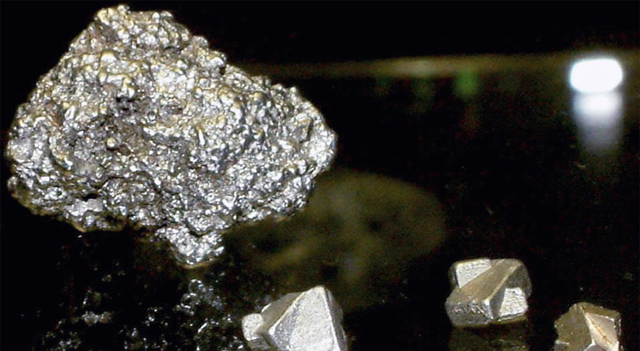

Sylvania Platinum Limited is a low-cost producer of platinum group metals—including platinum, palladium, and rhodium—based in South Africa. It specializes in retreating PGM-rich chrome tailings from mines within the Bushveld Igneous Complex, making it the industry leader in chrome tailings reprocessing. The company also holds mining rights in the Northern Limb of the BIC and is actively developing the Thaba Joint Venture, currently in commissioning phase.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Leave a Reply