Raspberry Pi Holdings plc (LSE:RPI) has reported a mixed financial performance for the first half of 2025, with revenue down 6% and profit before tax falling 43% compared to the prior year. Despite these declines, direct sales of single-board computers and Compute Modules rose 21%, driven by strong demand from OEM customers.

The company launched seven new products and reached a milestone as semiconductor unit volumes exceeded board unit volumes for the first time. Looking ahead, Raspberry Pi expects the second half of 2025 to deliver higher volumes supported by a strong order backlog, while maintaining full-year profit expectations.

While strong revenue growth and operational stability support the outlook, high valuation and bearish technical indicators temper investor sentiment. Positive corporate developments provide some support, but ongoing attention to efficiency and cash flow management remains crucial.

About Raspberry Pi Holdings plc

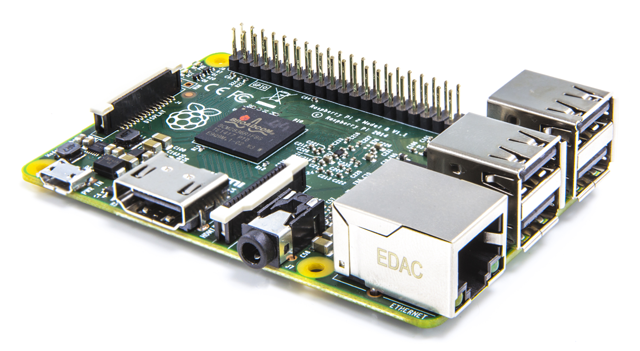

Headquartered in Cambridge, UK, Raspberry Pi Holdings is a leader in low-cost, high-performance computing platforms. The company operates as a full-stack engineering organization, with expertise in semiconductor IP development, electronic design, and software engineering. Its products serve industrial, educational, and semiconductor markets, and the company is also known for its contributions to the Raspberry Pi Foundation, supporting computing education worldwide.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Leave a Reply