Proteome Sciences (LSE:PRM) saw a decline in total revenues during the first half of 2025, primarily due to global trade disruptions and cuts in US research funding. Nevertheless, the company’s proteomics services experienced notable growth, particularly at its Frankfurt and San Diego facilities, with expectations for continued demand into 2026.

The company remains optimistic about future revenue expansion, driven by rising order volumes and new product innovations, including DXT tags for multiplexing. Sales of TMT reagents, however, were affected by reduced R&D budgets, though improvement is anticipated as industry conditions stabilize.

Proteome Sciences’ outlook is constrained by weak financial performance, marked by falling revenues, ongoing losses, and elevated debt levels. Technical indicators signal a bearish trend, while valuation metrics are unattractive due to negative earnings and the absence of a dividend. Limited insights from earnings calls and corporate events leave additional performance factors unclear.

Company Overview

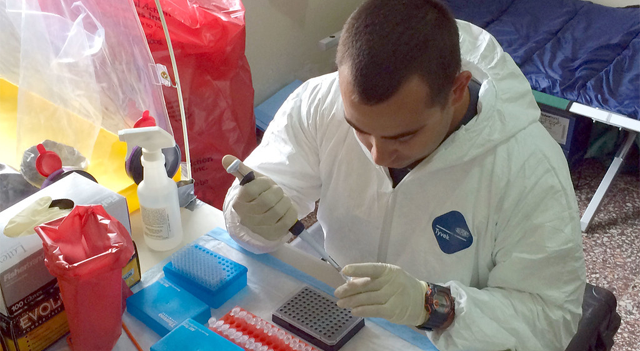

Proteome Sciences plc provides specialist contract proteomics services for drug discovery, development, and biomarker identification. Using proprietary workflows, the company analyses tissues, cells, and body fluids, offering products such as SysQuant® and TMT®MS2 for biological activity profiling. Headquartered in Cobham, UK, Proteome Sciences operates laboratories in Frankfurt, Germany, and San Diego, US.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Leave a Reply