Kenmare Resources (LSE:KMR) reported a difficult third quarter of 2025, as the upgrade of its Wet Concentrator Plant A temporarily reduced ilmenite production. While output was affected, the company reaffirmed its commitment to meeting full-year production and cost guidance, though ilmenite volumes are now expected to come in at the lower end of forecasts.

Market conditions remain challenging, with one customer unable to take delivery of contracted volumes. However, strong demand for zircon has provided some support. Kenmare is also working to extend its Implementation Agreement with the government and has stepped up security measures at its Moma mine following a recent theft incident.

Financial indicators present a mixed picture. The company’s solid equity base contrasts with falling revenues, lower profitability, and cash flow pressures. Technical signals point to a bearish trend, and a negative P/E ratio raises investor caution. Nevertheless, its attractive dividend yield may continue to appeal to income-focused shareholders.

About Kenmare Resources:

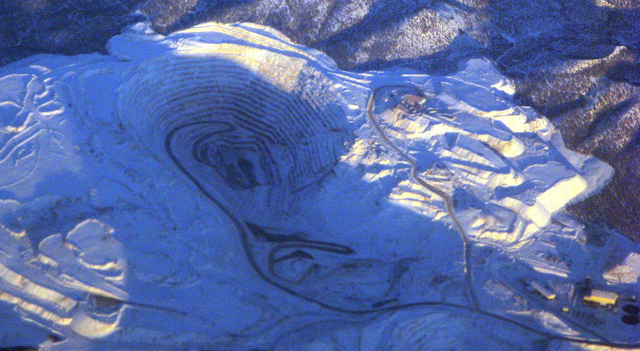

Kenmare Resources plc is a major global supplier of titanium minerals and zircon, operating the Moma Titanium Minerals Mine in northern Mozambique. The company’s core products include ilmenite, zircon, and rutile, which are key raw materials for a range of industrial applications.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Some portions of this content may have been generated or assisted by artificial intelligence (AI) tools and been reviewed for accuracy and quality by our editorial team.

Leave a Reply