EnSilica PLC (LSE:ENSI) has reported its audited financial results for the year ended 31 May 2025, showcasing solid contract momentum even as total revenues declined to £18.2 million year-over-year. The company achieved notable growth in chip supply revenues and improved gross profit margins, reflecting a strategic shift toward higher-value business segments. EnSilica secured multiple major contracts across telecommunications, industrial, and automotive sectors, with a combined lifetime value exceeding $100 million — a development that significantly strengthens its long-term growth pipeline.

The company continues to invest heavily in research and development to enhance its product offering and technological capabilities. With a goal of achieving cash flow positivity by 2026, EnSilica has outlined medium- and long-term revenue targets of £60 million and £100 million, respectively, underscoring its confidence in sustained expansion.

While EnSilica’s short-term valuation remains challenged by its lack of profitability and a negative P/E ratio, improving cash flow trends and strong contract wins point to encouraging growth potential. Technical indicators suggest moderate positive momentum, supported by the company’s expanding commercial footprint and robust order backlog.

More about EnSilica PLC

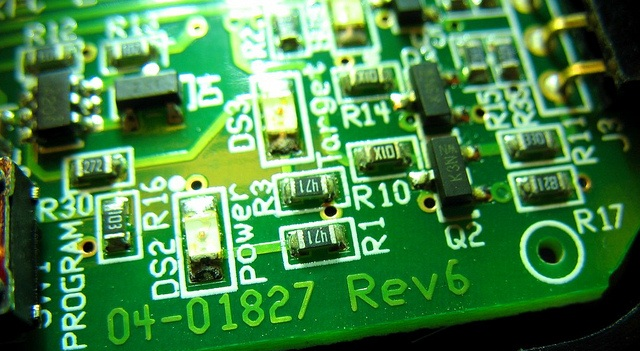

EnSilica PLC is a leading fabless semiconductor design house specializing in custom ASIC design and supply for original equipment manufacturers (OEMs) and system houses. The company provides advanced integrated circuit (IC) design services, with core expertise in RF, mmWave, mixed-signal, and digital ASICs. Serving clients across automotive, industrial, healthcare, and communications industries, EnSilica also offers a comprehensive portfolio of intellectual property in cryptography, radar, and communications. It operates design centers in the UK, India, and Brazil.

Leave a Reply