U.S. futures point to a slightly lower start on Monday, suggesting that stocks may extend the declines seen during last Friday’s trading session.

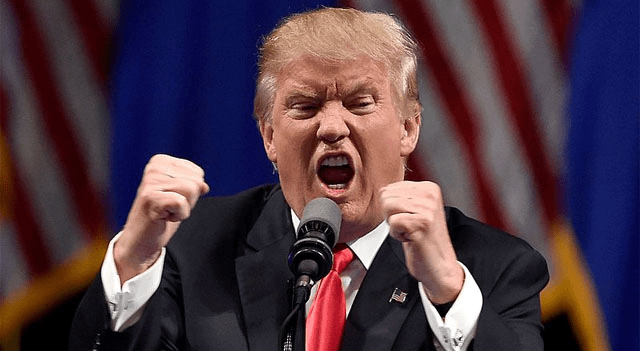

Market concerns remain elevated over President Donald Trump’s ongoing trade disputes, particularly after he sent letters to leaders of the European Union and Mexico threatening to impose 30 percent tariffs starting August 1.

In an early morning post on Truth Social, Trump accused the U.S. of being “ripen off” on trade for decades, resulting in trillions of dollars in losses.

“Countries should sit back and say, ‘Thank you for the many year’s long free ride, but we know you now have to do what’s right for America,’” Trump stated. “We should respond by saying, ‘Thank you for understanding the situation we are in. Greatly appreciated!’”

In response, the EU declared it will delay the enforcement of its retaliatory trade measures against the U.S. until early August, providing additional time to negotiate a resolution.

European Commission President Ursula von der Leyen, addressing the situation during a Sunday press briefing, said, “We will therefore also extend the suspension of our countermeasures till early August. At the same time, we will continue to prepare further countermeasures so we are fully prepared.”

She added, “We have always been very clear that we prefer a negotiated solution. This remains the case, and we will use the time that we have now till the 1st of August (to negotiate).”

The EU’s retaliatory tariffs targeting $25 billion worth of American imports, imposed in response to U.S. steel and aluminum tariffs, were originally set to take effect Monday.

Meanwhile, investors appear cautious ahead of several upcoming economic reports, including data on consumer and producer prices, retail sales, and industrial output.

The earnings season is also gaining momentum this week, with major companies such as JPMorgan Chase (NYSE:JPM), Wells Fargo (NYSE:WFC), Bank of America (NYSE:BAC), Goldman Sachs (NYSE:GS), Johnson & Jonson (NYSE:JNJ) and Netflix (NASDAQ:NFLX) scheduled to release quarterly results.

Last Friday, stocks recovered some losses after an early dip but still finished modestly lower. The major indices all slipped, with the Nasdaq and S&P 500 retreating from Thursday’s record closing highs.

The Dow dropped 279.13 points (0.6%) to 44,371.51, the Nasdaq declined 45.14 points (0.2%) to 20,585.53, and the S&P 500 lost 20.71 points (0.3%) to close at 6,259.75.

The market weakness was driven by renewed worries over Trump’s escalating trade conflicts.

In a letter posted on Truth Social to Canadian Prime Minister Mark Carney, Trump announced a 35 percent tariff on Canadian imports, effective August 1.

He attributed the tariffs partly to Canada’s failure to stop fentanyl from “pouring” into the U.S. and warned that tariffs could increase if Canada retaliates.

“If Canada works with me to stop the flow of Fentanyl, we will, perhaps, consider an adjustment to this letter,” Trump said.

During an interview on NBC News’ “Meet the Press,” Trump indicated plans to impose broad tariffs of 15 to 20 percent on most U.S. trading partners and mentioned he would soon send letters to EU members informing them of new tariff levels.

Trading activity remained somewhat muted overall, possibly due to the absence of significant U.S. economic data keeping some investors cautious.

Airline stocks retreated sharply after a strong rally in the previous session, causing the NYSE Arca Airline Index to fall 2.7 percent from Thursday’s four-month closing high.

Biotech stocks also showed notable weakness, with the NYSE Arca Biotechnology Index dropping 1.5 percent.

Other sectors experiencing pressure included networking, housing, and pharmaceuticals, while gold stocks advanced in line with rising gold prices.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.