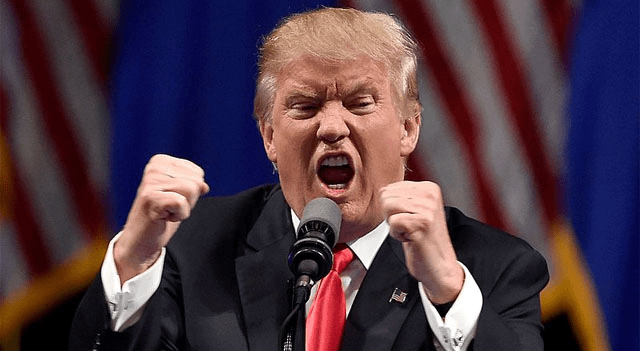

U.S. equity futures are trending lower Friday morning, signaling potential weakness at the market open as investors digest a fresh wave of tariff threats from President Donald Trump that could reignite global trade tensions.

The downturn follows two consecutive days of gains for the major indexes, as concerns mount over the White House’s confrontational trade stance. Sentiment soured after Trump unveiled new tariff plans targeting key trade partners.

In a public message addressed to Canadian Prime Minister Mark Carney and shared on Truth Social, Trump announced the U.S. would impose a 35% tariff on Canadian imports starting August 1. The move, he said, was partly in response to Canada’s failure to stem the flow of fentanyl into the U.S.

“If Canada works with me to stop the flow of Fentanyl, we will, perhaps, consider an adjustment to this letter,” Trump wrote.

Speaking on NBC’s “Meet the Press,” Trump further disclosed plans to implement blanket tariffs of 15–20% across most U.S. trade allies, including European nations. Additional letters notifying countries of new duties are expected soon.

The recent rhetoric has reawakened trade war fears among investors, just as earnings season looms and markets attempt to gauge broader economic momentum.

“The corporate reporting season begins in earnest next week with the big US banks. That will shift the focus to profits and outlook statements, giving valuable insight into how the business world is coping with a multitude of pressures,” said Dan Coatsworth, investment analyst at AJ Bell.

“Any corporate optimism is likely to prompt a tickertape parade on the markets as investors look for confirmation that tariff uncertainty hasn’t caused widespread damage to earnings,” Coatsworth added.

Although economic data releases are light, traders will be closely watching for clues on inflation and consumer strength as they weigh global risks against corporate performance.

Thursday’s session ended on a high note, albeit with some late-day easing. The Nasdaq and S&P 500 both set new all-time closing highs, while the Dow rose 192.34 points to 44,650.64. The Nasdaq edged up 19.33 points to 20,630.66, and the S&P 500 gained 17.20 points to end at 6,280.46.

Despite the bullish momentum, uncertainties persist. Trump’s trade threats show no signs of slowing. On Wednesday, he posted on Truth Social that copper imports would soon be hit with a 50% tariff starting next month. Additional letters addressed to leaders in countries like Libya, Iraq, Sri Lanka, Moldova, and Brunei laid out further tariff plans.

“Trump is throwing out numbers left, right and centre, and investors have begun to dismiss anything that isn’t set in stone,” Coatsworth remarked.

“So many of Trump’s decisions have either been rolled back, forgotten about, or kicked down the road,” he continued. “For investors, that means a shift in focus back to economic data and corporate news flow as key drivers for markets.”

In other developments, jobless claims data released by the Labor Department revealed that initial unemployment claims fell slightly to 227,000 for the week ending July 5, down 5,000 from the previous week. Analysts had expected an increase to 235,000.

Meanwhile, airline stocks led Thursday’s gains, with the NYSE Arca Airline Index surging 7.8%—its strongest level in four months—after Delta Air Lines (NYSE:DAL) reported impressive earnings and reinstated its annual guidance, sending its stock up 12%.

The steel sector also performed well, supported by a 1.8% rise in the NYSE Arca Steel Index. Energy, biotech, and financial shares made solid contributions, while tech sub-sectors like software and networking saw modest declines.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.