U.S. stock futures advanced on Monday, lifted by a surprise policy shift from Canada to scrap a controversial digital services tax. Meanwhile, the U.S. Senate, under Republican control, has kicked off deliberations on a far-reaching tax and spending proposal backed by former President Donald Trump. In Asia, Chinese manufacturing data showed a softer-than-expected contraction, helping ease concerns about global growth.

Markets Open on a Positive Note

Wall Street looked set for a stronger start to the week, with futures climbing across major indexes as investors cheered the Canadian government’s decision to withdraw a planned tax on tech giants’ digital revenues.

By 03:30 ET (07:30 GMT), futures tied to the Dow Jones Industrial Average were up 250 points, or 0.6%. S&P 500 futures rose by 23 points (0.4%), while Nasdaq 100 futures added 109 points (0.5%).

This comes after the S&P 500 and Nasdaq Composite both finished at record highs on Friday. The Nasdaq has officially entered a bull market, defined by a 20% gain from recent lows, reinforcing optimism in tech-heavy sectors.

Investor sentiment was further buoyed by data showing a dip in consumer spending in May, even as inflation remains above the Federal Reserve’s 2% goal. The unexpected decline in spending raised hopes that the Fed might cut interest rates as early as September. Market odds now price in a 74% chance of a rate cut by then, though some expect action could come even sooner in July.

Canada Withdraws Digital Services Tax

In a surprise weekend decision, Canada announced it would no longer implement a planned digital services tax, which was slated to take effect Monday. The move, seen as an effort to break a trade stalemate with the U.S., removed a major source of friction between the two nations.

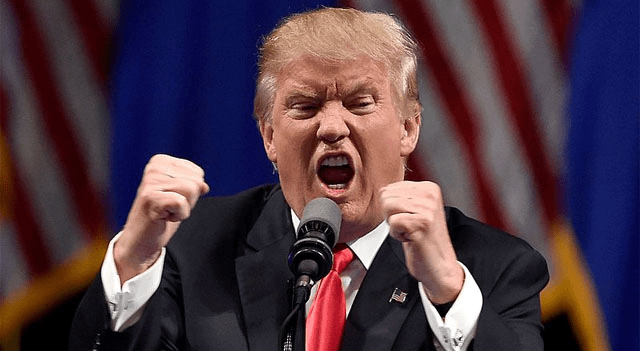

The tax, which targeted tech companies with over $20 million in Canadian digital revenue, was meant to apply retroactively to 2022. Its repeal followed threats from President Trump to impose retaliatory tariffs on Canadian exports, calling the policy “unacceptable.”

Ottawa now aims to reset the trade relationship, with talks between Canadian Prime Minister Mark Carney and President Trump scheduled ahead of a self-imposed July 21 deadline to strike a deal.

U.S. Senate Debates Sweeping Economic Legislation

In Washington, the Senate has opened formal debate on a major tax and spending bill championed by Trump, though internal divisions within the Republican Party and pushback from Democrats pose hurdles to quick passage.

The proposal would extend key provisions from Trump’s 2017 tax cuts, while also increasing funding for defense and border security. The Congressional Budget Office projects the plan could add approximately $3.3 trillion to the national debt over the next ten years.

Despite these concerns, the bill is expected to clear the Senate, possibly as early as Monday. Lawmakers hope to finalize the legislation and deliver it to President Trump for signature by July 4.

China’s Factory Activity Shrinks, but Signs of Improvement Emerge

Chinese manufacturing data for June indicated continued contraction, though at a slower pace than analysts had expected. The manufacturing purchasing managers’ index (PMI) came in at 49.7, slightly ahead of projections and up from 49.5 in May.

This marks the third consecutive month of contraction in China’s manufacturing sector, largely due to weak international demand and lingering U.S. tariffs. However, the slight uptick in the PMI reflects modest gains in conditions following a May agreement between Washington and Beijing to cut tariffs on some goods.

Efforts to solidify that agreement into a broader trade framework continued in June, raising hopes that improved bilateral relations will support Chinese exporters.

Oil Prices Slip Amid Easing Middle East Tensions and OPEC+ Expectations

Crude oil prices edged lower to start the week as geopolitical risk premiums faded and traders anticipated a potential output increase from OPEC+.

At 03:35 ET, Brent crude futures were down 0.2% at $66.66 per barrel, while West Texas Intermediate (WTI) fell 0.4% to $65.26.

Despite last week’s sharp decline—the steepest weekly drop since March 2023—both oil benchmarks remain on track to post a second straight monthly gain of over 5%.

The OPEC+ alliance is due to meet on July 6, with markets widely expecting the group to approve another increase in production—the fifth such move since April’s decision to gradually unwind output curbs.