U.S. stocks ended at all-time highs Wednesday, led by a strong tech rally after Nvidia became the first semiconductor company to top a $4 trillion valuation. The surge helped markets shake off concerns over President Donald Trump’s latest tariff moves.

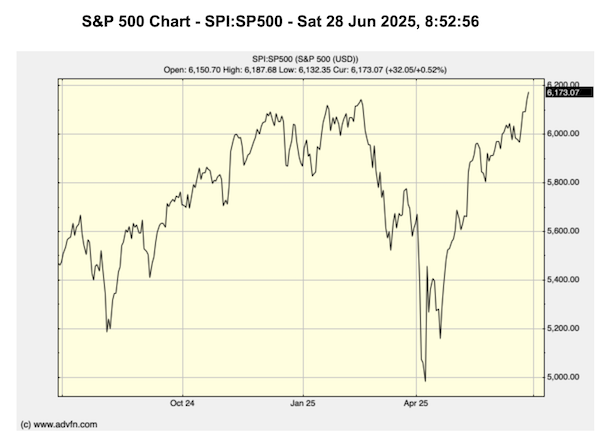

At the close, the Nasdaq 100 Futures jumped 0.95% to a record 20,611.34. The Dow Jones Industrial Average added 217 points (0.5%) and the S&P 500 gained 0.6%.

Nvidia Hits $4 Trillion, Fuels AI-Driven Tech Rally

Nvidia (NASDAQ: NVDA) rose 2%, lifting its market value above $4 trillion and reaffirming its lead in AI chip dominance. The rally sparked broader gains in the tech sector.

“This is a historic moment,” said Wedbush analysts. “It reflects the AI Revolution entering its next phase, powered by Nvidia’s chips.”

Meta Platforms (NASDAQ: META) and other major tech names also traded higher.

Fed Minutes: Rate Cuts Still Likely This Year, but Divisions Emerging

Minutes from the Fed’s June 17–18 meeting show most officials expect rate cuts later in the year, though opinions are beginning to diverge. Some policymakers favor cuts as early as July, while others see no need to ease policy just yet.

President Trump has been vocal in criticizing the Fed’s caution, again calling for lower rates and even for Chair Jerome Powell’s resignation. He recently cited a study claiming tariffs have not fueled inflation.

According to The Wall Street Journal, Trump’s adviser Kevin Hassett has emerged as a leading candidate to replace Powell, overtaking former Fed governor Kevin Warsh.

Copper Becomes Latest Target in Trump’s Trade War

Markets started the week on shaky ground after Trump issued new tariff threats to major global partners. Although the effective date was pushed from July 9 to August 1, the president insisted no further delays are coming.

Trump also raised the possibility of a 50% tariff on imported copper, spotlighting his administration’s sector-specific trade strategy. Copper is vital to industries like electric vehicles, military, and infrastructure.

More tariffs—potentially on pharmaceuticals and semiconductors—may soon follow. Treasury Secretary Scott Bessent claimed tariffs have generated $100 billion so far in 2025, with a target of $300 billion by year-end.

Goldman Sachs: Limited Upside for Stocks in the Near Term

Despite the recent surge, Goldman Sachs warned of limited near-term upside in equities due to stretched valuations and macroeconomic risks.

While neutral over the next three months, strategists led by Christian Mueller-Glissmann remain optimistic over the next year, citing long-term structural drivers, policy support, and strong shareholder returns.

Still, they caution: “In late-cycle phases, valuations tend to overshoot, and with weakening inflation trends abroad, the risk of a market pullback is now greater than that of a major rally.”