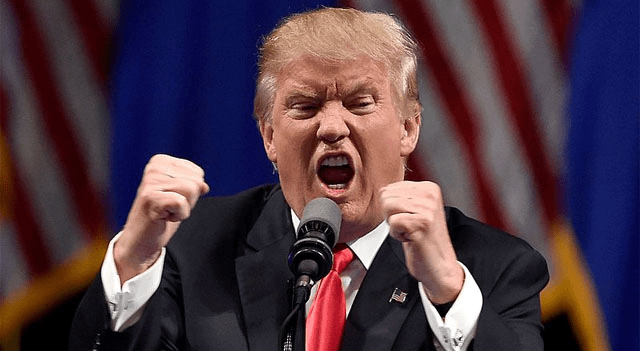

Futures tied to major U.S. equity benchmarks struggled to establish a clear direction on Wednesday, as investors balanced fading geopolitical tensions with anticipation of a heavy flow of U.S. economic indicators. President Donald Trump said the United States and Venezuela have reached an agreement under which Caracas will export up to $2 billion of domestically produced crude oil to the U.S., just days after a high-profile U.S. military operation that resulted in the capture of Venezuela’s leader. Separately, attention is also turning to corporate earnings, with Constellation Brands set to release its latest quarterly results amid signs of slowing demand.

U.S. futures lack conviction

U.S. stock futures moved little in early trading, reflecting a cautious tone as market participants weighed recent geopolitical developments against the prospect of fresh macroeconomic data.

By 02:47 ET, futures on the Dow Jones Industrial Average were higher by 46 points, or 0.1%. In contrast, S&P 500 futures edged down 6 points, or 0.1%, while Nasdaq 100 futures slipped 50 points, or 0.2%.

Wall Street ended the previous session in positive territory, supported by a rally in semiconductor shares linked to continued enthusiasm around artificial intelligence. Memory and storage technology companies, including Seagate Technology, SanDisk and Micron Technology, benefited from comments made by Nvidia chief executive Jensen Huang at a closely watched technology conference. Huang said the company’s next generation of chips will feature an additional layer of storage technology designed to allow chatbots to deliver faster responses to longer and more complex queries.

Elsewhere, Moderna shares jumped nearly 11% after analysts at BofA Global Research raised their price target for the biotechnology group.

Energy stocks, however, retreated after gains earlier in the week that followed the U.S. military action targeting Venezuelan President Nicolas Maduro. Shares in Chevron fell 4.5%, while Exxon Mobil declined 3.4%.

Trump confirms oil export deal with Venezuela

President Trump said on Tuesday that Washington and Caracas have agreed on a deal that will see Venezuela export up to $2 billion of crude oil to the United States.

Trump has previously insisted that Venezuela and its interim president, Delcy Rodríguez, grant the U.S. and American oil companies full “access” to the country’s extensive and highly profitable oil industry. He has warned that failure to meet these demands could expose Venezuela to further U.S. military intervention.

In a post on social media, Trump said Venezuela would be “turning over” between 30 million and 50 million barrels of “sanctioned oil” to the United States. Millions of barrels have been unable to leave the country since Washington imposed a blockade in December.

According to Reuters, the agreement could initially force the diversion of oil shipments that were previously bound for China, which has been one of Venezuela’s largest crude buyers over the past decade.

Oil prices moved lower following the announcement. Brent crude futures were down 0.9% at $60.18 a barrel, while U.S. West Texas Intermediate crude fell 1.2% to $56.46 a barrel.

Focus shifts toward economic data

Analysts at ING said in a note that the “shock” from the U.S. strike on Venezuela has “largely faded,” with oil prices returning to levels seen before the incident and equity markets continuing to advance.

“Unless the U.S. escalates threats on Greenland or intervenes again in Venezuela, markets should refocus on data in the second half of the week,” the analysts, including Frantisek Taborsky and Francesco Pesole, wrote.

The White House has said Trump is weighing options to acquire Greenland, including the possible use of military force, arguing that the territory is strategically important for U.S. national security. European leaders have strongly opposed the idea.

Despite lingering uncertainty around U.S. foreign policy ambitions, market attention is expected to pivot toward a series of closely watched U.S. economic releases.

Economists forecast that data from payrolls processor ADP will show private-sector employers added around 49,000 jobs in December, following a decline of 32,000 in November. Separately, another report is expected to show that job openings — a key gauge of labour demand — edged down slightly to about 7.61 million in November.

Labour market conditions have been central to recent interest rate decisions by the Federal Reserve. Policymakers cut borrowing costs several times in 2025, placing greater emphasis on supporting a weakening jobs outlook than on signs of stubborn inflation.

ISM services data in focus

Markets are also awaiting fresh data on activity in the U.S. services sector. The non-manufacturing purchasing managers’ index from the Institute for Supply Management is expected to ease slightly to 52.2 in December from 52.6 in the previous month.

In November, the services sector was largely stable, with subdued hiring and rising input costs. Because services account for more than two-thirds of total U.S. economic output, the ISM report could offer important insight into the health of the world’s largest economy toward the end of the fourth quarter.

Constellation Brands earnings ahead

On the corporate front, investors are preparing for results from Constellation Brands. According to Bloomberg estimates, the company is expected to report adjusted earnings per share of $2.64 for its fiscal third quarter on net sales of roughly $2.16 billion.

Beer shipment volumes are forecast to decline by 2.91%, while depletion volumes — which measure sales to end consumers — are expected to fall by 3.96%. The beer segment accounts for the majority of Constellation’s overall revenue.

Constellation and rivals such as Molson Coors and Brown-Forman have been grappling with softer demand for alcoholic beverages, alongside higher tariffs on aluminium cans that have squeezed profit margins. In addition, concerns around immigration policy and broader economic uncertainty have weighed on spending among Latino consumers in the U.S., a key demographic for brands such as Corona and Modelo.