EnSilica plc (LSE:ENSI) said trading in the first half of its 2026 financial year has been ahead of expectations, with revenue set to increase by more than 35% to approximately £12.7 million. The group also reported a marked improvement in profitability, with EBITDA moving from a small loss in the prior period to an estimated profit of around £1.7 million, supported by solid non-recurring engineering activity and growing recurring revenues from chip supply contracts.

The company highlighted rising demand across several technology-driven end markets, including satellite communications and secure, long-lifecycle systems. Growth in these areas has been underpinned by customer interest in EnSilica’s security intellectual property that is designed to be ready for post-quantum cryptography, reflecting increasing focus on long-term data security and resilience. Management said this mix of contracted engineering work and repeat silicon revenues is improving both visibility and resilience in the business model.

EnSilica reaffirmed its full-year outlook, guiding for revenue of £28–30 million and EBITDA of £3.5–4.5 million. The company noted that a large proportion of expected turnover is already under contract and outlined a pathway toward achieving positive monthly cash generation by the end of 2026, reinforcing confidence in its medium-term growth trajectory.

Despite the upbeat operational update, the broader outlook remains tempered by historical financial challenges, including periods of declining revenue, losses and weaker free cash flow. Technical indicators provide some support, with the share price trading above key moving averages and a positive MACD signal, although elevated RSI and stochastic readings point to potential near-term volatility. Valuation metrics remain constrained by negative earnings and the absence of a dividend.

More about EnSilica plc

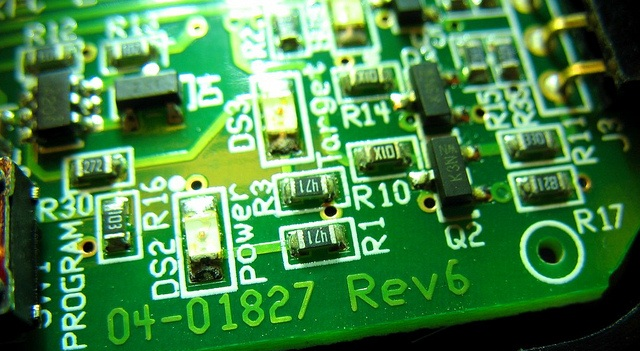

EnSilica plc is a UK-headquartered, fabless application-specific integrated circuit (ASIC) designer specialising in mixed-signal, RF, mmWave and complex digital ICs. The company serves communications, industrial, automotive and healthcare markets where safety, security and reliability are critical. It leverages a growing portfolio of reusable IP and silicon platforms to deliver long-term chip supply solutions, supported by design centres in the UK, India, Brazil and Hungary.