U.S. stock futures plunged Wednesday as the federal government shut down, driving investors toward safe-haven gold amid concerns over potential economic impacts. Meanwhile, Nike delivered encouraging news as its first-quarter results signaled early success for its turnaround strategy.

Government Shutdown Hits U.S. Operations

Much of the U.S. government ceased operations Wednesday after a last-minute spending bill supported by Republicans failed to pass the Senate due to Democratic opposition.

This marks the 15th shutdown since 1981 and the second under President Donald Trump, who has threatened additional federal layoffs. Tens of thousands of workers have already left this year, and over 150,000 federal employees are expected to exit payrolls this week following buyouts—the largest exodus in 80 years.

There is no clear solution in sight, raising concerns that this shutdown could last longer than previous budget-related closures due to deep political divisions. The longest shutdown in U.S. history spanned 35 days from December 2018 to January 2019 during Trump’s first term over border security.

The shutdown is expected to delay the release of Friday’s crucial September employment report, disrupt air travel, suspend scientific research, withhold pay for U.S. troops, and furlough 750,000 federal workers at a daily cost of $400 million.

U.S. Futures Fall

U.S. stock futures declined as investors worried about growth prospects. At 03:00 ET, S&P 500 futures fell 55 points (0.8%), Nasdaq 100 futures dropped 155 points (0.6%), and Dow futures fell 295 points (0.6%).

Major indices had closed higher Tuesday despite the looming shutdown, with September providing an unusually strong trading month. The S&P 500 logged a 7.8% gain for Q3.

Historically, Wall Street has often risen during shutdowns, but this episode is more worrisome as investors remain concerned about a slowing labor market and the Trump administration’s plans to shrink federal payrolls significantly.

The ADP private payroll report, scheduled later in the session, will be closely watched, while Conagra Brands (NYSE:CAG) leads corporate earnings releases.

Payroll Report Likely Delayed

A key consequence of the shutdown is the probable delay of Friday’s nonfarm payroll report for September, a critical gauge of the labor market. Investors are looking to this report for insight into labor conditions, which influenced the Fed’s September rate cut.

Doubts about further cuts emerged after hawkish Fed commentary. Dallas Fed President Lorie Logan stated Tuesday that “the labor market will need to deteriorate further for the central bank to consider more rate cuts.”

Data released Tuesday showed U.S. job openings rose slightly in August while hiring slowed, signaling a softening labor market that might allow the Fed one more cut this month. The ADP National Employment Report, expected later, is projected to show a modest increase of 50,000 private-sector jobs.

Nike Impresses with Q1 Growth

Nike (NYSE:NKE) gained attention after posting stronger-than-expected first-quarter results, signaling progress in CEO Elliott Hill’s turnaround plan despite challenges in China and tariff pressures.

The company reported quarterly profits above Wall Street expectations, boosted by stronger wholesale revenue, pushing shares up over 3% in after-hours trading.

Nike revealed that tariffs could cost roughly $1.5 billion this year, higher than the $1 billion projected earlier, due to production in countries like Vietnam affected by U.S. tariffs.

“This quarter Nike drove progress through our Win Now actions in our priority areas of North America, Wholesale, and Running,” Hill said.

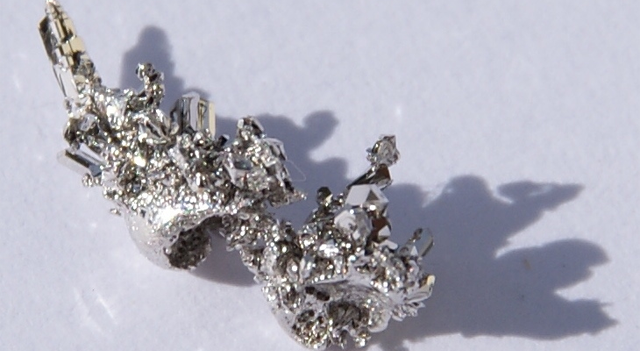

Gold Hits New Records

Gold prices soared to record highs as the government shutdown intensified safe-haven demand. Spot gold reached $2,875.53 an ounce, while December gold futures peaked at $3,903.45/oz.

The yellow metal has set multiple records this week as U.S. political deadlock pressured the dollar, prompting investors to favor safe assets. Other precious metals have also surged, with platinum and silver hitting 12- and 14-year highs, respectively.

Oil Prices Stabilize

Oil steadied after two days of declines amid considerations of OPEC+ production plans and the shutdown’s potential economic impact. Brent futures rose 0.4% to $66.29/barrel, and WTI gained 3% to $62.58/barrel.

Earlier this week, both benchmarks fell sharply—over 3% Monday and another 1.5% Tuesday. OPEC+ could boost output by up to 500,000 barrels per day in November, three times the October increase, Reuters reported.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.