As the world’s need for electronic devices and renewable energy accelerates, silver is hitting record highs in demand and pricing, and the surge shows no signs of easing.

This article is disseminated on behalf of New Pacific Metals Corp. It is intended to inform investors and should not be taken as a recommendation or financial advice.

The nonstop need for silver continues increasing its value for investors, but high demand also puts pressure on limited supplies. A few producers are stepping up their output, ready to accommodate global needs.

“Silver is indispensable to everyday life and the global economy,” said Jalen Yuan, CEO of New Pacific Metals Corp. (AMEX:NEWP) (TSX:NUAG) “Dedicated silver exploration and development is taking on increasing urgency for its power to deliver consistent returns in a fluctuating market while also promising better lives for people the world over.”

Silver on the upswing

At the end of 2025, silver prices reached all-time highs above $60 an ounce, and in and after peaking at over $120 per ounce in January 2026, it remained over $75 per ounce.

What’s driving industrial demand? In essence, anything with an on/off switch probably needs silver – and silver only. Industry requires silver for its unparalleled conductive qualities, and unlike copper and other metals, alternatives are scarce.

Silver is essential for the growing electronics and sustainability sectors. Industry is now consuming 59 percent of the world’s silver output, applying it to:

- Solar energy panels. Silver converts sunlight to electrons and carries the electricity generated. Despite a slowdown in U.S. incentives, global solar installations rose by 33 percent in 2024 and are expected to continue rising in the low double digits through 2029, according to Solar Power Europe.

- Electronic devices. One-third of the world’s silver goes toward electronics, creating electrical pathways and facilitating light-touch on/off switches in cellphones, tablets, toys, and more.

- AI and data centers. The data centers powering AI have become the fastest-growing electronics category. They need silver for cloud infrastructures, high-speed networking, and cooling systems.

- Automotives. Electric vehicles consume twice the silver of gas-powered vehicles for their additional electrical systems and power management components. Half all vehicles sold by 2035 are expected to be EVs, predicts the International Energy Association.

- Wearables. Increasingly, smart rings, watches, pendants, and even clothing are monitoring biometrics, sleep, activity, and personal air quality.

“As we become more connected in society, we become more reliant on electronic devices, and demand for silver is going to stay very strong,” said Trevor Keel, technical director, the Silver Institute.

A geopolitical player

While industrial demand rises, silver is also gaining popularity as a safe haven for investors seeking certainty amid the global political strife. Since the U.S. Geological Survey listed silver as a “critical mineral” essential to national security, some analysts expect stockpiling by the U.S. and other nations.

Precious metals analyst David Morgan suggested the possibility of a 3x rise in silver prices from their mid-2025 levels. Metals markets, he said, are moving “at a sprint,” as institutions and the public seek them out to hedge against currency disruption.

The confluence of surging demand for silver and political uncertainty “is enough to more than move the needle on continued safe-haven demand for gold and silver,” said Kitco News analyst Jim Wyckoff.

Global mine production reached a seven-year high of 844 million ounces in 2025, according to the Silver Institute, but like a bathtub that drains faster than it fills, it isn’t enough. The World Silver Survey projects a shortfall of 118 million ounces in 2026.

“In short, silver supply is sticky, but demand is anything but,” said Amit Pabari, managing director, CR Forex Advisors.

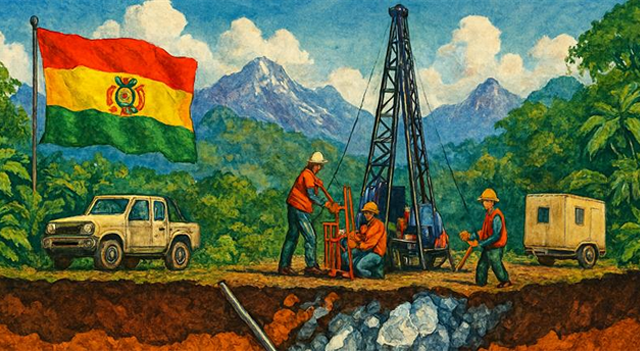

Bolivia to the forefront

A look at Mining.com’s top 20 silver-producing regions, including Poland, Mexico, and Russia, shows an array of barriers in silver production. Mining companies encounter strikes, land use disputes with communities, and logistical challenges. One leading company changed its domicile and sold its Russian assets to evade U.S. sanctions in 2023.

In this atmosphere, Bolivia is emerging as a safe and stable supplier of the silver the world needs. Bolivia is the world’s fourth-largest silver producing country, rich with minerals and, unlike Mexico and other silver regions, underexplored geographically, with limited modern exploration. Mining exports doubled year-over-year in 2020, and a new, mining-friendly government is inviting foreign investment.

New Pacific Metals, a Canadian exploration and development company advancing precious metal projects in Bolivia, owns two of the world’s largest undeveloped open pitable silver projects, positioning the company as a major future supplier to meet global demand.

New Pacific’s permitting-stage Silver Sand project in Bolivia’s Potosi region could become one of the world’s largest pure silver mines, with the potential to produce about 12 million ounces of silver annually at all-in sustaining costs of below $11 an ounce.

New Pacific’s Carangas Silver–Gold Project in Oruro strengthens the company’s portfolio through scale, robust economics, and regional exploration potential. Major steps expected at Carangas in 2026 include a 30,000-meter drilling program to upgrade and expand gold and silver resources, finalization of a community agreement, advancing the environmental license through strong government engagement and community partnerships, complete conversion from an exploration license to an exploitation license, and an updated preliminary economic assessment to include a gold zone.

When underway, Carangas’ development could add about 6.6 million ounces to annual supply.

Combined, the Silver Sand and Carangas Silver-Gold projects could produce as much or more silver output than many established global producers. The strong economic fundamentals of the projects are evident in high internal rates of return and low all-in sustaining costs per ounce of silver.

With more than a decade of operating experience in Bolivia, New Pacific has earned the confidence of stakeholders and shareholders, including major ownership shares by industry leaders Silvercorp Metals, at 28 percent, and Pan American Silver, at 12 percent. The commitment of highly reputable industry players demonstrates their confidence in the projects while assuring strategic and technical backing. Headquartered in Vancouver, British Columbia, the company’s shares trade on the Canadian Securities Exchange under NUAG and on the New York Stock Exchange under NEWP.

“The New Pacific Metals strategy for strong ROI in Bolivia is built on careful project identification and acquisition, thorough geological study, well-planned drilling, and long-term shareholder value creation,” said Yuan. “Our corporate social responsibility team is constantly on the ground, building respectful ties with local and national stakeholders. With its extensive commitments and strategic approach to bringing the Silver Sand and Carangas projects to fruition, New Pacific offers investors a rare opportunity to capitalize on an underdeveloped region now poised for significant contributions to meeting the world’s demand for silver.”

For more information, please visit newpacificmetals.com/welcome.

Leave a Reply