REACT Group Plc (LSE:REAT) posted robust financial results for the year ending September 2025, driven by solid revenue growth and strategic execution. Total revenue increased 21% year-on-year to approximately £25 million, while gross profit climbed 40% to £8 million, reflecting the company’s emphasis on high-margin, time-sensitive services and recurring maintenance contracts.

The company’s financial resilience was further strengthened by the integration of 24hr Aquaflow Services, acquired earlier in the year. The addition has expanded REACT’s customer base and created new growth channels, though net debt rose as a result of the transaction.

Despite challenging economic conditions, the board expressed confidence in its long-term growth strategy and ability to generate sustainable value for shareholders.

While the company’s strong fundamentals support a positive outlook, bearish technical signals and a negative P/E ratio highlight ongoing market risks that investors should monitor.

More about REACT Group Plc

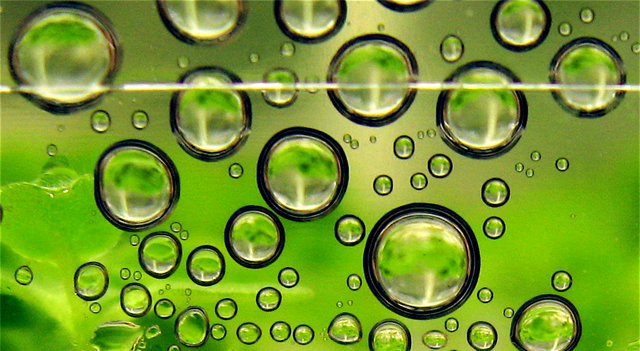

REACT Group Plc is a leading UK support services provider within the facilities management sector. Its divisions—including LaddersFree, Fidelis Contract Services, REACT, and 24hr Aquaflow Services—offer essential services such as commercial window and contract cleaning, emergency cleaning solutions, and commercial drainage and plumbing services.