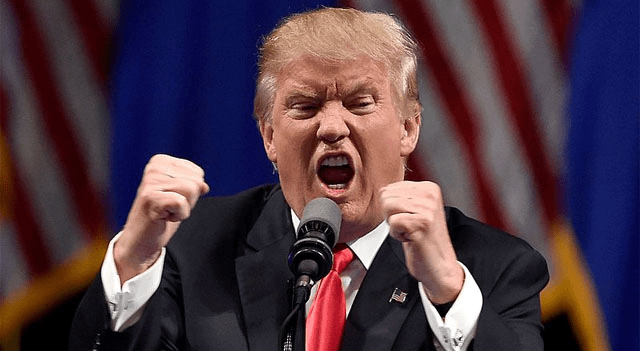

U.S. stock futures mostly rose Tuesday as investors digested President Donald Trump’s latest moves on tariffs. Trump sent formal letters to over a dozen countries detailing the higher tariffs they will face but extended the deadline for implementing these levies. Meanwhile, China warned Washington against reigniting trade tensions.

Futures Show Moderate Gains

By early Tuesday morning, Dow futures were steady, S&P 500 futures ticked up slightly by 0.1%, and Nasdaq 100 futures rose 0.2%. Markets had pulled back on Monday following Trump’s tariff letters, as some traders took profits amid uncertainty. Yet optimism remains as some investors believe Trump may remain open to negotiation, supported by signs of steady economic growth and easing inflation pressures.

Analysts from Vital Knowledge noted, “Despite Monday’s dip and tariff concerns, market bulls continue to drive the conversation.”

Tariff Letters Signal Increased Levies but Flexible Timeline

On Monday, Trump sent tariff notifications to 14 countries, warning of upcoming tariff hikes higher than the current baseline 10%, though somewhat less steep than his initial April announcements. The new deadline to enforce these tariffs was moved to August 1, giving countries—including major suppliers like Japan and South Korea—more time to negotiate.

Asked about the firmness of the new deadline, Trump said it was “firm, but not 100%,” signaling openness to alternative proposals if trading partners request adjustments.

Notably, these new tariffs will not overlap with existing sector-specific tariffs on cars, steel, and aluminum. India and the European Union were not included in the latest round of notifications, fueling speculation that trade agreements with these entities may be forthcoming.

Japan signaled continued willingness to negotiate, with Prime Minister Shigeru Ishiba affirming ongoing talks. South Korea’s Trade Minister Yeo Han-koo also met U.S. Commerce Secretary Howard Lutnick to discuss potential tariff exemptions or reductions in key sectors.

China Cautions U.S. Against Escalation

In a related development, China urged the U.S. to avoid reigniting tariff disputes that could undermine the fragile trade truce recently agreed upon. Although the U.S. and China reaffirmed a trade framework in June after marathon negotiations, many details remain unclear, casting doubts over the durability of the agreement.

China has until August 12 to reach a deal with the U.S., or risk facing tariff rates exceeding 100% on some goods. The People’s Daily, the official Communist Party newspaper, called for continued dialogue and cooperation but condemned Trump’s tariffs as “bullying.” It also warned smaller countries against striking deals with the U.S. that exclude China, threatening retaliation.

Oil Prices Slip Amid Trade and Supply Concerns

Crude oil prices edged down as investors weighed the uncertain impact of tariffs on global demand alongside rising production from OPEC+. Brent crude futures fell 0.1% to $69.54 per barrel, while U.S. West Texas Intermediate futures declined 0.2% to $67.76.

OPEC+ recently announced an increase of 548,000 barrels per day in August production—more than the boosts seen in May, June, and July—adding pressure to the market amid trade-related demand worries.

Amazon Launches Extended Prime Day Sales

Amazon (NASDAQ:AMZN) kicked off its Prime Day event Tuesday, extending the annual sales event to four days this year, longer than usual. Analysts predict U.S. online spending during the event will hit $23.8 billion, a 28.4% jump over last year’s two-day sale.

Amazon attributes the longer event to members requesting more time to shop deals. In 2024, Americans spent $14.2 billion during Prime Day, representing an 11% increase from the previous year.

The event faces stiff competition from rivals Walmart, Target, and TikTok Shop, who are also targeting younger shoppers eager for back-to-school discounts. Amazon has responded with special offers and discounted Prime subscriptions for younger consumers.