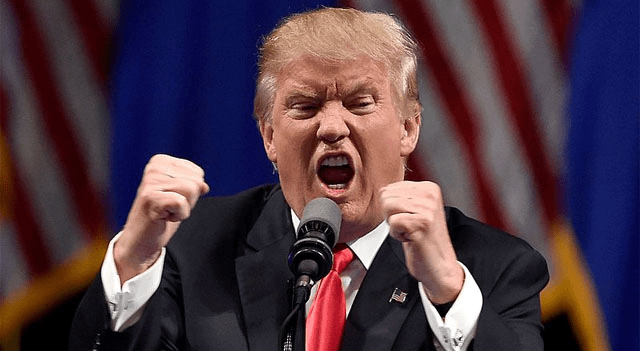

European equities showed a mixed performance on Wednesday, with investors adopting a cautious stance ahead of U.S. President Donald Trump’s speech at the World Economic Forum later in the day.

By 08:05 GMT, Germany’s DAX was down 0.3%, France’s CAC 40 was broadly flat, while the UK’s FTSE 100 edged 0.1% higher.

Trump heads to Davos

Market sentiment has been under pressure this week after U.S. President Donald Trump threatened to escalate tariffs on several European allies unless the United States is allowed to purchase Greenland, the autonomous Danish territory.

Speaking at a press conference late Tuesday, Trump reiterated his position that the island needs to become U.S. territory.

“I think we will work something out where NATO is going to be very happy and where we’re going to be very happy. But we need it for security purposes. We need it for national security,” he said.

When asked how far he would go to secure Greenland, Trump offered a brief response: “You’ll find out,”

raising concerns that he may use the Davos platform to intensify his push — a move that could further strain relations with European allies.

Earlier on Wednesday, Christine Lagarde, head of the European Central Bank, said the European economy needs a “deep review” to confront “the dawn of a new international order”. Lagarde added that U.S. tariffs would likely have only a modest inflationary impact overall, though Germany would be more affected than France, and argued that Europe would be stronger if it dismantled non-tariff trade barriers within the bloc.

UK inflation accelerates in December

UK inflation surprised to the upside in December, with consumer prices rising more than expected. The annual CPI rate climbed to 3.4% from 3.2% in November, above forecasts of 3.3%, according to data released earlier in the session.

Inflation in Britain remains the highest among the G7 economies, despite weak economic growth. However, economists expect price pressures to ease in the coming months as last year’s increases in energy costs and other regulated prices drop out of the annual comparison.

Corporate movers in focus

In company news, Burberry (LSE:BRBY) exceeded expectations for sales growth during the crucial holiday quarter and guided for full-year profit in line with forecasts, helped by improved demand from China and a strategic refocus on its British heritage.

Premier Foods (LSE:PFD) posted a strong third-quarter performance, reporting a 5.2% increase in branded revenue after better-than-expected Christmas trading.

Atos (EU:ATO) said preliminary fiscal 2025 revenue reached €8 billion, meeting its target, while net cash outflow was lower than anticipated.

Barry Callebaut (BIT:1BARN) reported a 9.9% decline in first-quarter sales volumes and announced that Hein Schumacher will take over as chief executive later this month.

InPost (EU:INPST) said full-year 2025 parcel volumes jumped 25%, driven by strong international growth and a sharp rise in UK deliveries, with total volumes reaching a record 1.4 billion parcels.

Outside Europe, Netflix (NASDAQ:NFLX) drew attention after beating expectations for fourth-quarter revenue and earnings, while also signalling a pause in share buybacks as it builds cash amid intense bidding competition for Warner Bros Discovery.

Oil prices slide on Greenland tensions

Oil prices fell sharply on Wednesday amid concerns that escalating trade tensions linked to the Greenland dispute could weigh on global growth.

Brent crude futures dropped 1.5% to $63.95 a barrel, while U.S. West Texas Intermediate fell 1.3% to $59.56. Both benchmarks had closed nearly 1.5% higher in the previous session after OPEC+ producer Kazakhstan temporarily halted output at two oilfields, raising supply concerns.

Beyond geopolitics, markets are awaiting a monthly report from the International Energy Agency later in the day, as well as updates on U.S. crude oil and gasoline inventories. Weekly data from the American Petroleum Institute is due later Wednesday, with official figures from the Energy Information Administration scheduled for Thursday, both delayed by one day due to a U.S. federal holiday earlier in the week.