European equity markets traded slightly firmer on Tuesday, with investors balancing geopolitical risks against key economic data and the start of the quarterly earnings season.

By 08:05 GMT, Germany’s DAX was up 0.1% and London’s FTSE 100 added 0.1%, while France’s CAC 40 slipped 0.1%.

Wall Street momentum offers support

European sentiment took a modest boost from the U.S., where the S&P 500 closed at a fresh record high, led by continued strength in technology stocks. Markets were also encouraged by gains in Asia after Japan’s Nikkei 225 reached a new peak, helped by reports that Prime Minister Sanae Takaichi could call an early election to strengthen her parliamentary position—a move that could open the door to additional fiscal stimulus.

Despite these positives, upside in Europe appeared capped as investors remained focused on escalating tensions in Iran. Widespread protests against the country’s clerical leadership have reportedly been met with force, raising concerns over instability in the region.

U.S. President Donald Trump said on Monday that any country doing business with Iran would face a 25% tariff on trade with the United States. Iran’s main trading partners include China, several East Asian economies, Iraq, the United Arab Emirates, Turkey and Germany. Trump is also expected to meet senior advisers later in the day to review policy options on Iran.

U.S. inflation data awaited

With little in the way of European economic releases on Tuesday, attention is firmly on the latest U.S. consumer price data, the final major inflation reading ahead of the Federal Reserve’s policy meeting later this month.

Economists expect headline CPI to come in at 2.7% year on year for December, unchanged from November, with monthly inflation also seen holding at 0.3%. Core inflation, which excludes food and energy, is forecast to edge higher to 2.7% annually from 2.6%, and to 0.3% month on month from 0.2%.

Corporate news in focus

In Europe’s corporate sector, Lindt & Spruengli (TG:LSPP) said organic sales rose just over 12.4% in 2025, slightly ahead of market forecasts, with the Swiss chocolatier benefiting from higher cocoa prices.

Sika (TG:SIKA) reported a 4.8% decline in full-year sales, as weak construction demand and currency headwinds offset growth achieved in local currencies.

In the UK, Whitbread (LSE:WTB) posted a 2% rise in third-quarter group sales, supported by stronger accommodation revenue in both the UK and Germany.

However, much of the market’s attention is on the U.S., where earnings from JPMorgan Chase (NYSE:JPM) and Bank of New York Mellon (NYSE:BK) later in the session will effectively kick off the Wall Street earnings season. Expectations for banks are generally upbeat, though Trump’s announcement that credit card interest rates will be capped at 10% from January 20 could complicate the outlook.

Oil prices extend gains

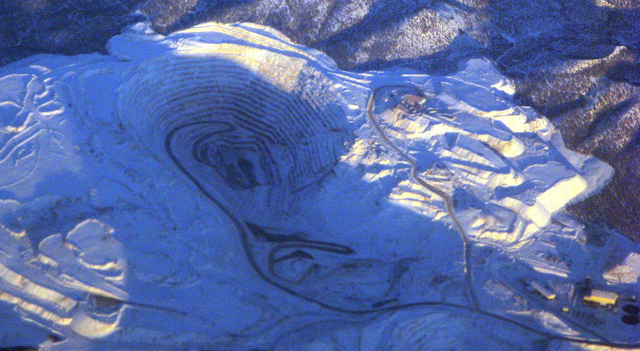

Oil prices moved higher for a fourth straight session, as concerns grew over potential supply disruptions from Iran amid intensifying unrest.

Brent crude futures rose 0.5% to $64.16 a barrel, while U.S. West Texas Intermediate gained 0.8% to $59.82. Brent hit a seven-week high in the previous session, with WTI touching a one-month peak.

Iran, one of OPEC’s largest producers, is facing its most significant wave of anti-government protests in years, adding to uncertainty around global energy supply.